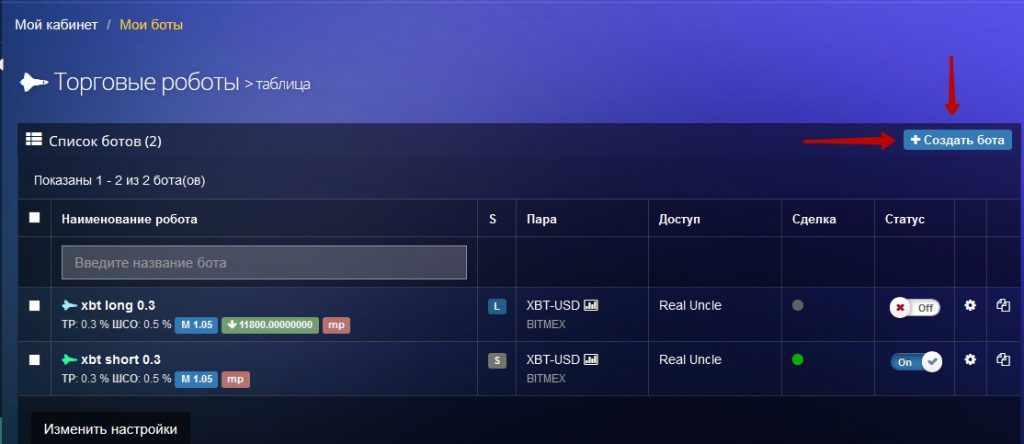

Создание Bitmex бота (основные параметры)

Для настройки нам понадобится раздел — Мои боты — https://margin.cryptorg.net/ru/bot/index

Переходим в раздел и нажимаем – Создать бота — https://margin.cryptorg.net/ru/bot/create

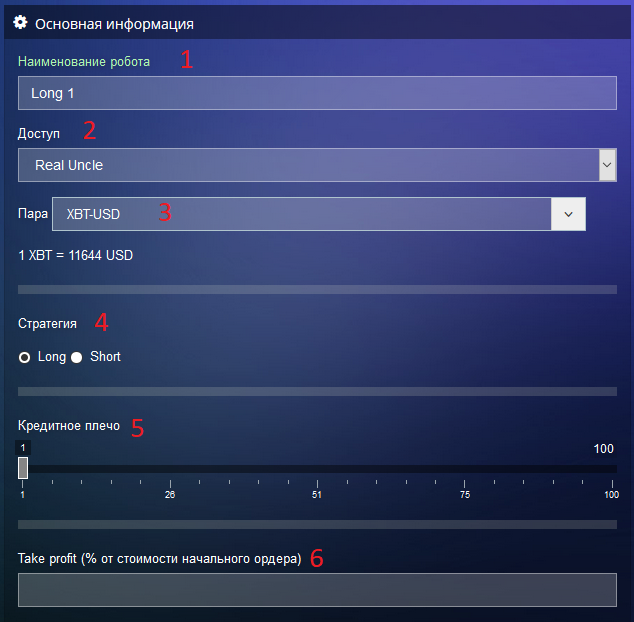

Далее рассмотрим настройки по пунктам:

- Наименование робота – рекомендовано указывать название пары или направление сделки, чтобы быстро ориентироваться в своих ботах. Например, XBT Long.

- Доступ – аккаунт биржи, на котором будет работать бот.

- Пара – торговая пара по которой будут вестись сделки.

- Стратегия — в long или short будет торговать бот.

- Кредитное плечо — объем заемных средств на которые вам нужно увеличить собственные средства, чем выше плечо, тем опаснее торговля.

- Take profit — сколько профита должен брать бот с каждой сделки. Ордер Take profit выставляется в процентах от начального ордера, сразу после открытия сделки.

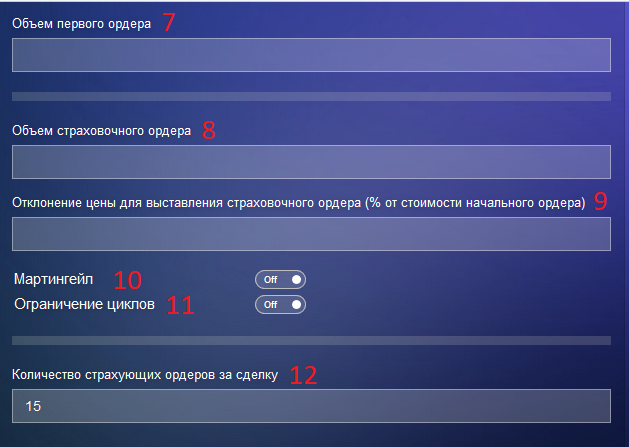

7. Объём первого ордера — начальная сумма сделки. На эту сумму будет происходить первая покупка после открытия сделки.

8. Объём страховочного ордера – на эту сумму бот будет выставлять страховочные ордера после открытия сделки на докупку для усреднения. Объём страховочного ордера не может быть меньше объёма первого ордера.

9. Отклонение цены для выставления страховочного ордера. Часто его называют шаг страховочного ордера (ШСО) — процент %, через который будут выставляться СО.

Например, цена начала long сделки – 10000 USD, ШСО – 1 %, бот выставит ордера на докупку вниз по цене 10900, 10800, 10700.

10. Мартингейл — при активации бегунка в положение On появляется возможность выбора повышающего коэффициента для каждого последующего ордера. Коэффициент более 1.10 считается достаточно агрессивным. Будьте внимательны при выборе параметров.

11. Ограничение циклов — при активации бегунка в положение On появляется возможность выбора количества циклов, которое проведет бот и выключится. Количество циклов — это количество сработавших Take Profit. Бот отрабатывает нужное кол-во сделок, выключается, а далее трейдер анализирует рынок и принимает решение о включении long или short бота.

12. Количество страховочных ордеров за сделку — максимальное количество (СО), которые могут быть исполнены за все время проведения сделки.

К примеру, у вас ШСО – 1 %.

Количество СО – 15 ордеров.

Значит ваша сетка может выдержать просадку в 15% для набора позиции.

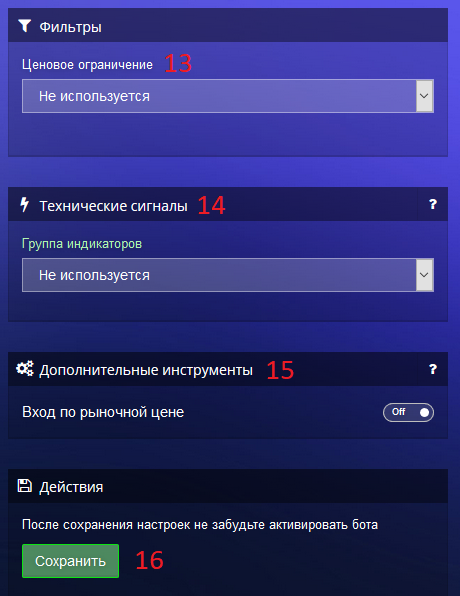

13. Фильтры. Ценовое ограничение. При желании можно воспользоваться дополнительными фильтрами для открытия сделки в виде ценовых ограничений. В выпадающем меню можно выбрать:

- Верхнее ценовое ограничение

- Нижнее ценовое ограничение

- Верхнее и нижнее ценовое ограничение

Подробно о работе с ценовыми ограничениями можно прочесть в данном разделе https://support.cryptorg.net/knowledge-base/price/

14. Технические сигналы. В выпадающем меню можно выбрать три типа индикаторов для открытия сделки:

- Скользящие средние

- Пересечение скользящих средних

- Осцилляторы

Подробно о работе технических сигналов можно ознакомиться в данном разделе https://support.cryptorg.net/knowledge-base/technical-signals/

Примеры срабатывания точек BUY и SELL можно посмотреть на этой странице https://tradingbeep.com/ru/documentation

15. Дополнительные инструменты. Все страховочные ордера выставляются по лимитной цене. Начальный же ордер можно исполнить по рыночной или лимитной цене. Мы всегда рекомендуем исполнение начального ордера по рыночной цене, чтобы избежать частичных исполнений и простоя бота.

16. Сохранение настроек. Не забудьте сохранить бота после внесения всех настроек. И после сохранения нажать кнопку включения.