Ликвидация на Bitmex

Каким же образом биржа страхует от потери суммы большей, чем сумма депозита при использовании плеча? Ликвидация на Bitmex, это как раз то, что спасает от масштабных потерь и ухода депозита в минус, она отвечает за полное аннулирование вашей сделки с безвозвратной ликвидацией ваших средств.

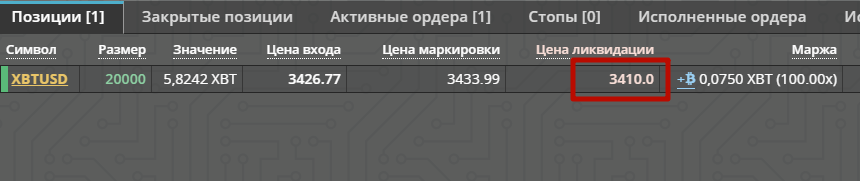

Цена ликвидации (ЦЛ) всегда видна в вашей открытой позиции, торгуя бессрочными контрактами, ЦЛ — единственный ваш ограничитель. Как далеко ЦЛ будет от точки вашего входа, зависит от выбранного плеча. Чем больше плечо, тем ближе ликвидация.

- Если вы торгуете в Кросс (Cross), и цена достигнет ликвидации – вы потеряете все средства. Поэтому когда торгуете в Cross, открывайте позиции не на весь депозит, а на его часть, чтобы в случае, если цена пойдёт против вас – вы могли усредниться.

- Изолированная торговля – в случае, если вы выбираете под каждую сделку часть депозита и самостоятельно устанавливаете плечо, при достижении цены ликвидации вы потеряете не все средства, а только ту часть, которую выделили.

Как уйти от ликвидации?

Для изолированной торговли:

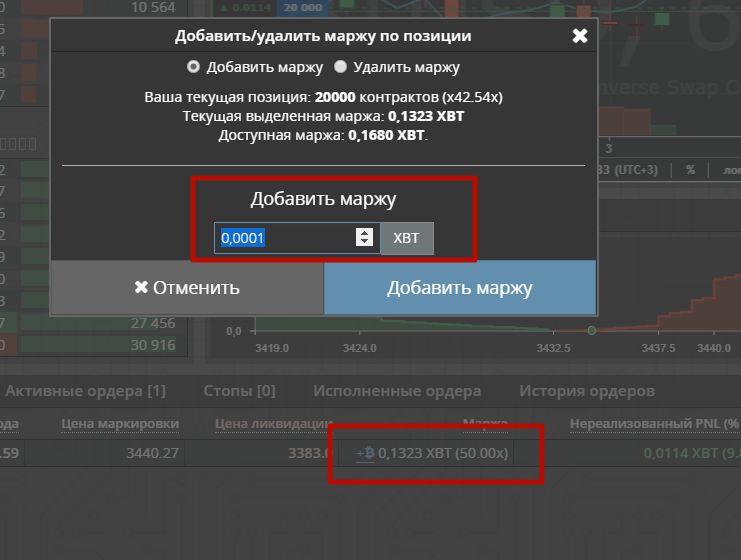

- Если торгуете изолировано то вы можете добавить маржи в сделку со свободных средств, тем самым подвинуть цену ликвидации.

- Усреднение сделки. Ваш депозит 0.1 XBT (примерно 800$ по текущему курсу), трейдер вошел в long на отметке 8000$ объемом ордера 100$ и используя плечо х10. Уровень ликвидации позиции будет находиться примерно на уровне 7200$. Цена идет против трейдера и падает до 7900$, на этом уровне трейдер усредняется тем же объемом в 100$ и плечом х10, средняя цена покупки составит 7950$ и уровень ликвидации снизится на 50$ ниже.

Для кросс-торговли:

- Если вы торгуете в CROSS, то отодвинуть цену ликвидации можно только пополнив депозит. Делать это нужно только очень в крайних случаях, лучше использовать Stop-Loss.

- Если подходит ликвидация, а свободных денег нет, то можно продать часть позиции и ее использовать для добавления в маржу, цена ликвидации передвинется автоматически

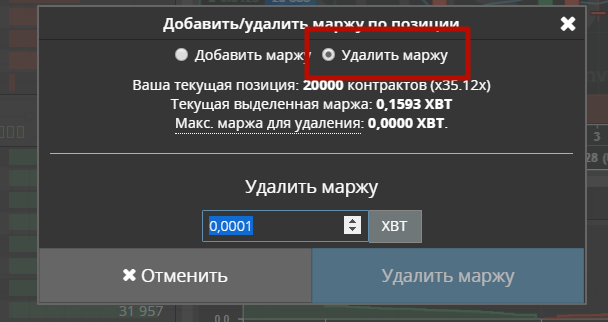

Обратите внимание, если убрать часть маржи со сделки, тем самым можно приблизить цену ликвидации ближе к текущей цене, что рискованно!