Типы ордеров на Bitmex

На бирже Bitmex доступно большое количество различных ордеров. Все они имеют свои отличительные особенности и именно от них зависит то, как именно вы будете торговать на бирже.

Можно открывать 2 позиции – Long (Buy) и Short (Sell).

- Long (Покупка) – покупаем контракты и продаём дороже.

- Short (Продажа) – продаём контракты и откупаем дешевле.

Рыночный ордер

Самым простым типом ордеров являются рыночные. Активируя рыночный ордер трейдер мгновенно совершает покупку или продажу по стакану, скупая чужие ордера

Сразу после входа в сделку, неважно это рыночный или лимитный ордер, сделка отобразится во вкладке позиции

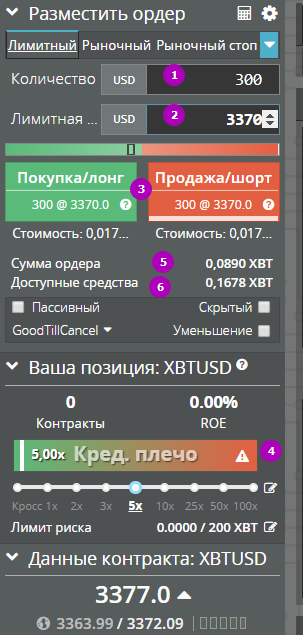

Лимитный ордер (Limit Order)

Отложенная покупка/продажа необходимого количества контрактов называется лимитным ордером. При исполнении лимитного ордера комиссия выплачивается трейдеру

- Задаем кол-во в USD

- Выставляем ожидаемую цену

- Выбираем Long или Short

- Выставляем нужное кредитное плечо.

- Смотрим сумму ордера и доступные средства.

- Обратите внимание что в колонке Количество (1) вбивается сумма, уже с учётом плеча и вычисляется в XBT в колонке 5.

Все ожидающие исполнения лимитные ордера отображаются в специальной вкладке «активные ордера»

Скользящий стоп (Trailing stop).

Тип рыночного ордера, имеющий интересное преимущество. Трейдер открыл long позицию и она вышла в плюс на 200$. Трейдер не знает сколько еще будет расти рынок, он хочет следовать за ценой. В скользящем ордере можно задать количество контрактов и уровень, который будет следовать за ценой.

Допустим текущая цена 8000$, трейдер ставит в скользящем ордере уровень отклонения 100$. При падении цены на 7900$ сделка автоматически закроется. Если же цена продолжит расти и достигнет 8300$, то скользящий стоп автоматически передвинется уже на уровень 8200$. Трейдер получит больше прибыли чем при фиксированном тейк-профите. Скользящие стопы особенно хороши на импульсном движении рынка, когда цена за короткий промежуток времени проходит большое расстояние.

Если вы работаете в Long – количество надо задавать со знаком «-», если в Short – со знаком «+».

Функции ордеров

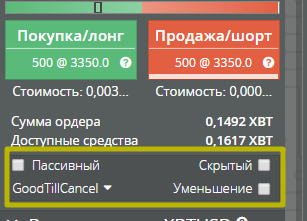

Доступны непосредственно под окном выбора, но в зависимости от выбранного типа, галочки будут отличаться. При выборе лимитного ордера доступны такие, а для рыночного их вообще нет. Разберемся что к чему:

- Пассивный ордер (Post-Only) — Включает задержку при размещении ордера по рынку позволяя сэкономить на комиссии и более того, получить рибейт. Биржа платит за открытие лимитного ордера, это и называется рибейт, чтобы гарантированно его получить нужно выставить галочку — пассивный.

- Скрытый (Hidden) — это лимитный ордер, который не отображается в общедоступной биржевой книге. Отметив поле «Скрыть», пользователи могут открыть скрытый лимитный ордер, лимитный стоп-ордер или лимитный ордер с фиксацией прибыли. Трейдеры используют ордер этого типа, когда предпочитают, чтобы их действия на рынке оставались незамеченными.

- Уменьшение — полезная штука для закрытия позиций, например одновременно ставить стоп-лосс и тейк-профит, чего нет на многих биржах. При установке этой галочки, ордер не сможет увеличить вашу позицию, только уменьшить. Например, вы купили BTC по 3400 и ставите два ордера — один limit sell по 3500, другой — stop sell на 3300. Если вы поставите галочку reduce only в них, то исполнится только один из этих ордеров. Если же нет, то может случиться такое, что сначала сработает стоп и продаст ваши битки, затем цена дойдет до 3500 и у вас откроется шорт, который потом придется закрывать.

- Годен до отмены – действует до ручной отмены.

- Выполнить сразу или отменить – ордер исполняется моментально, но если какая-то его часть не ушла, биржа её отменит.

- Исполнить сразу или аннулировать – полная отмена заявки, если она не может быть исполнена

История ордеров

Все исполненные ордера доступны на специальной вкладке, можно увидеть врем исполнения вплоть до секунды

История ордеров, даже не исполненных, также доступна на специальной вкладке.