Trading terminal. Working with the terminal. Types of orders

The trading terminal is located at https://cryptorg.net/en/futures/USDT-BTC

All liquidity is identical to Binance Futures. Cryptorg is a Binance broker

Attention! The exchange operates in a hedge mode. This means that it is possible for the same trading pair to have a position both long and short!

The exchange displays only one average trading position for both long and short. Example: if buy orders of the same volume at 5000 and 10000 were triggered, then the trade position will display a buy at 7500.

The main working areas of the trading terminal

- The zone with various statistical information is located in the center at the top

- On the left, the display of available trading pairs and the last transactions completed on the exchange

- On the right is a journal (order book) of buy and sell orders

- In the center is the main work area, trading schedule

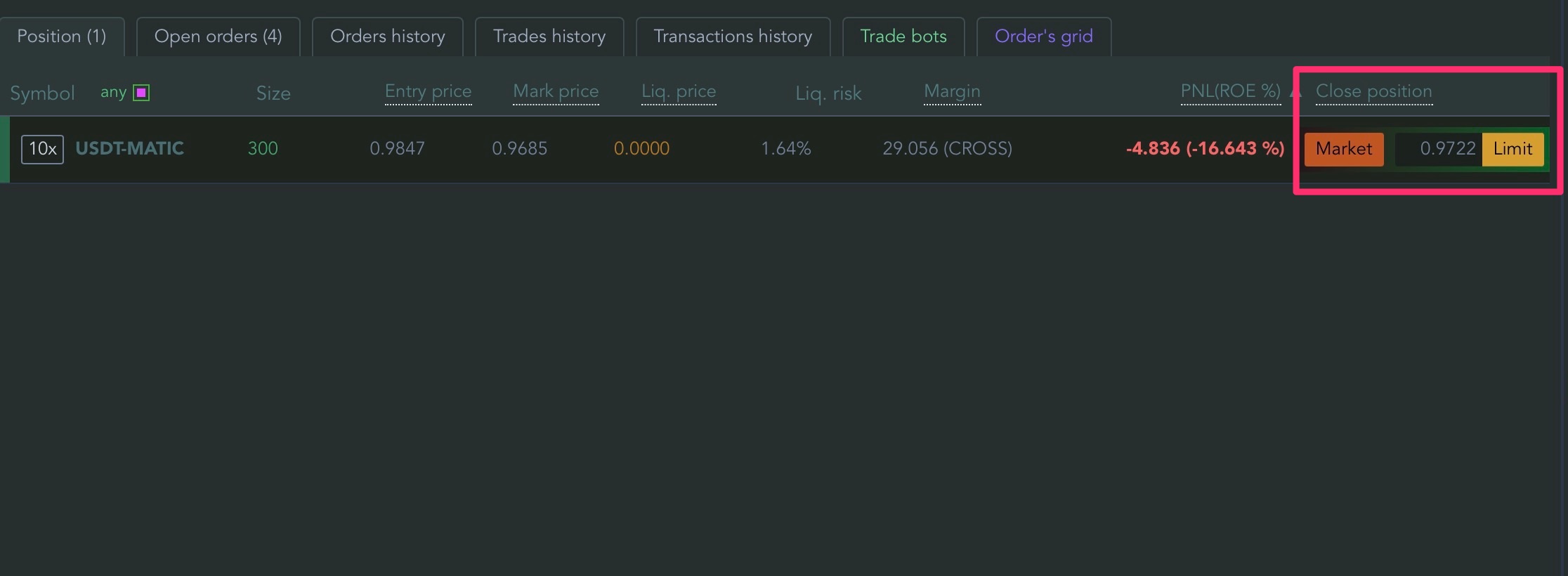

5. Zone where information on current and past trades is displayed. History of trade operations and transactions.

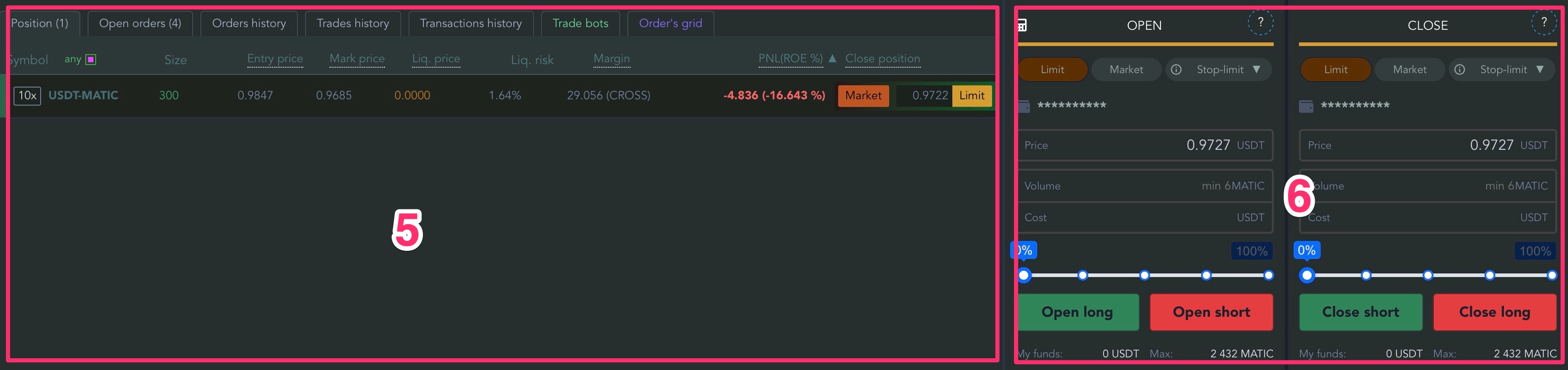

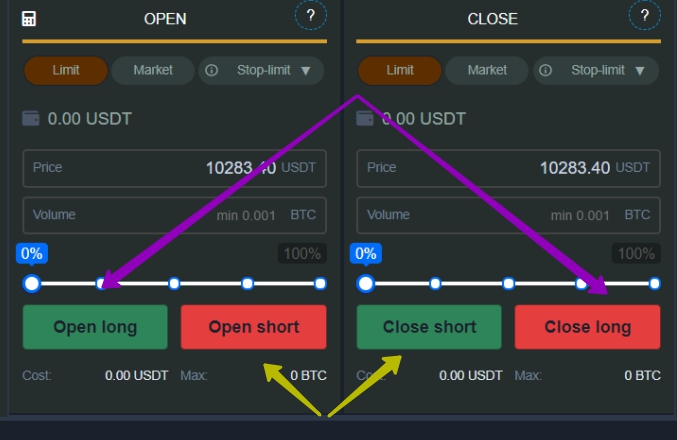

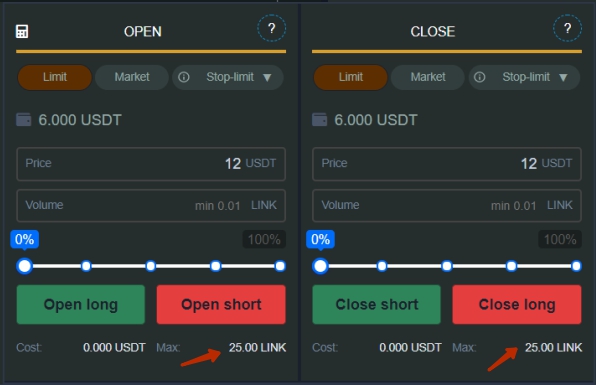

6. Trade area. Opening and closing positions

Opening / Closing Positions

You can open a position both long and short only from the left menu window

You can close an open position from the right menu window

You can also close a position directly from the position status bar.

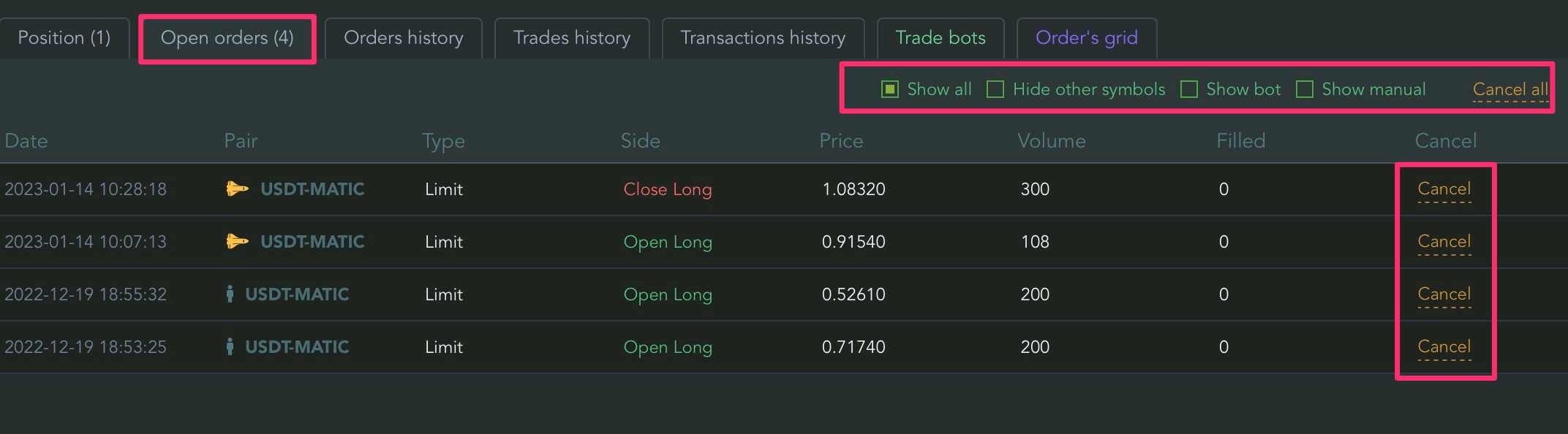

Open orders

The open orders tab displays a list of orders. You can filter them by selecting all orders, orders for the current pair, bot orders or manual orders. You can also cancel them all with one button. We strongly recommend you to check this tab periodically for extra and forgotten orders.

Managing bots in the terminal

Read https://support.cryptorg.net/ctg-en/terminal-bot-management/

Order’s grid

Read https://support.cryptorg.net/exchange-en/grid/

Working with orders on the chart

You can delete orders directly from the chart with one click. To delete an order, simply click the cross on the right side of the order.

To move the order, pull on the left side of it.

How to determine how much volume can be entered into a deal as much as possible?

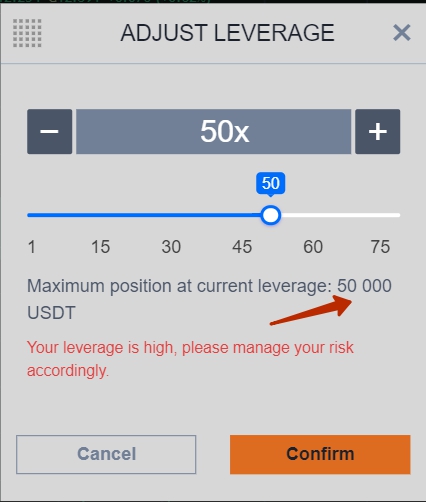

The system will determine what the maximum position volume can be opened based on your leverage and the type of margin. A hint can be seen at the bottom of the position opening window

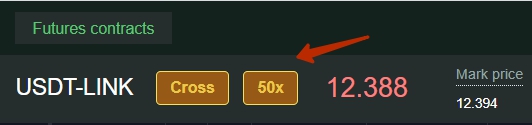

Also pay attention to the tips at the top of the terminal. When you click on the leverage of the selected pair, the system will tell you what the maximum position volume can be for the selected trading pair. Please note that for many altcoins, when choosing a large leverage, the maximum possible trading volume is severely limited. Consider this when choosing a trading style

Types of orders / Working with orders

- Limit Order — allows you to place a pending order with a specific value. It will be executed only when the course matches the declared value. A limit order can be placed using the open / close long / short buttons. This type of order can be used to open a position and place a Take Profit.

- Market (market order) — when placed, instantly executed at the best available price. In case of lack of liquidity or rapid price movement, the price can be executed at different prices. To create it, you need to enter the volume and press the open / close long / short buttons. This type of order can be used to open and close a position.

- Stop-limit order — the system places a limit order when the price (trigger) you specified is reached. To place this type of order, you need to specify the trigger price and the price of the actual placing of the limit order. After the trigger is triggered, a regular limit order is placed in the order book. This type of order can be used both to open a position and to close by take profit or stop loss.

An example of opening a LONG position. The current price is 9000. The trader assumes that the price will go to 9150, then a rebound to 9100 will occur and the price will go up again. The trader places a stop-limit order with a trigger at 9200 and a price at 9150. After the price rises to 9200, the trigger is triggered and a limit order is placed at 9150.

Don’t put the trigger and the strike price too close together! In moments of sharp market movements, slippages can occur!

- Stop market order — the system places a market order when the price (trigger) you specified is reached. To place this type of order, you need to specify the trigger price. After the trigger is triggered, an instant buy / sell on the market occurs. This type of order can be used both to open a position and to close by take profit or stop loss.

An example of opening a LONG position: the current price is 9000, we want to buy at 9150. We put the trigger at 9150. After the price rises to 9150, the trigger will be triggered and the required volume will be instantly redeemed by the market.

An example of closing a LONG position at breakeven: Current price 9000. Position opened from 8800. PNL +200. The trader wants to play it safe and go to bed calmly, knowing that the position will be closed in positive territory. The trader places a stop-market order to close the long with a trigger at 8950. If the market goes down to 8950, the system will place a market order itself and the position will be instantly closed. This replaces the case if the trader himself sat at the workplace and reacted to the price movement in an unfavorable direction for him.

- Trailing Stop — Allows you to place a pre-order. Set the activation price and% deviation. After the price reaches the required level, an order with the required deviation percentage will be activated. At the same time, the system monitors each tick of the price movement and pulls the order by the price. This type of order can be used both to open a position and to close by take profit or stop loss.

An example of opening a position: the current price is 9000, set the trigger at 9200 and deviation of 1%. After the price reaches 9200, a buy order will be placed 1% lower. If the price continues to go up, then the opening order will move higher, following at a distance of 1%

Please note that the system automatically rejects / deletes orders that do not meet the exchange conditions or the state of your margin!

Information on current and past trades. History of trade operations and transactions.

- Position — all active transactions and their financial results are displayed here

- Open Orders — all active pending limit orders are displayed here

- Order history — all previously placed orders are displayed here, both triggered and deleted

- Trading history — the entire trading history, opening / closing positions and financial results are displayed here

- Transactions — all transfers of usdt to / from the exchange, trading commissions, accruals / withdrawals of% funding, financial results of transactions, etc. are displayed here

- Trading bots — management of bots via the terminal

- Order’s grid — manual trading with automatic placement of orders

Trade history visualization

Our trading terminal allows you to visualize your trading history. The arrows on the chart show all purchases and sales. Red arrows — sales, green arrows — purchases. It is a great tool for analyzing your own trading.