Money management and an example of bot setup

Money management is the process of managing your funds in order to save them and multiply them.

Because futures trading involves risks, you must correctly organize the trading process, correctly allocate funds in transactions to avoid liquidation of positions/deposits, as well as to get a profit.

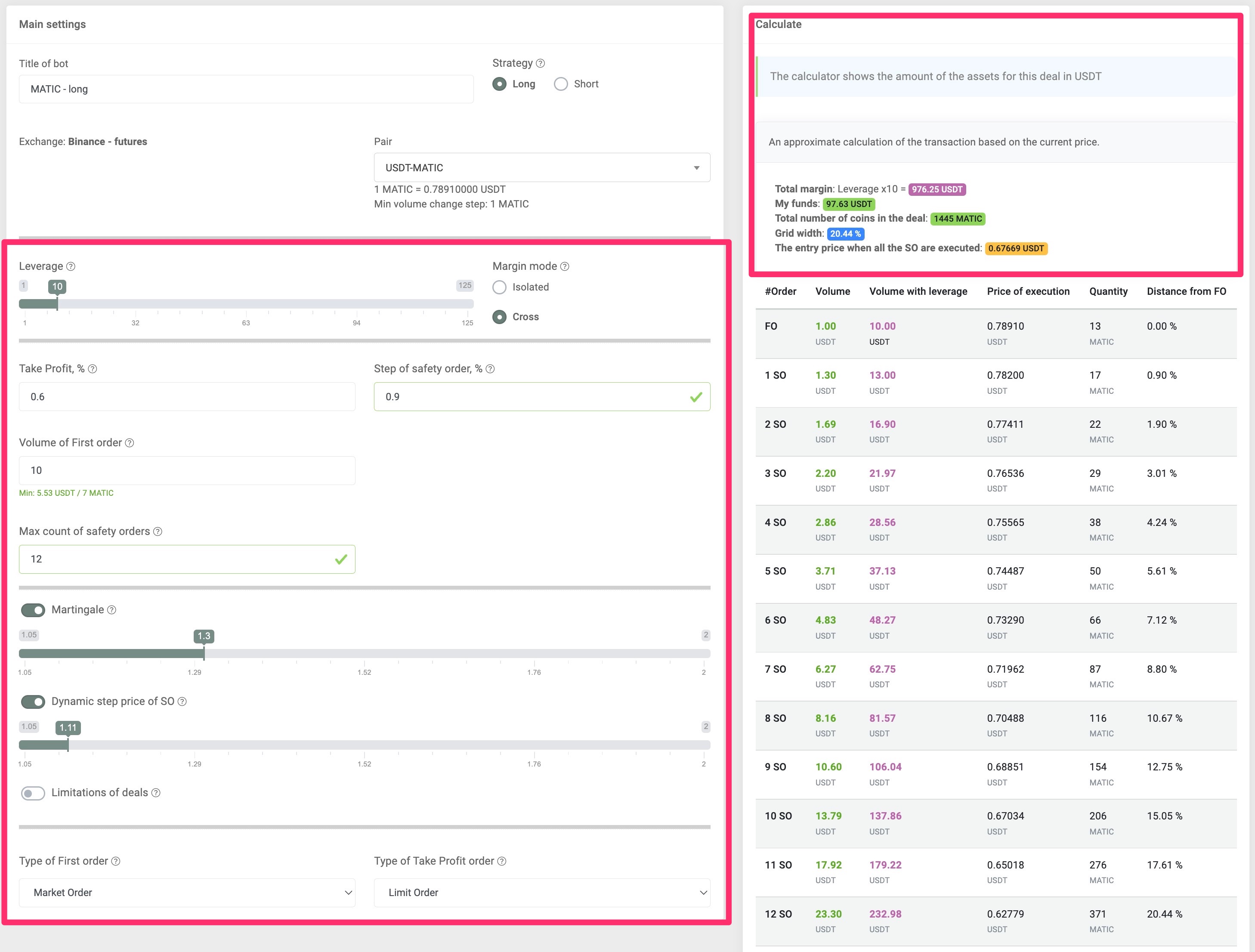

In this example, let’s consider setting up a bot with a crossed margin for a deposit of 1500 USDT

First of all, you should understand that the described strategy is more typical for the long strategy. Because the price can fall by 100% downwards and rise by 1000% or more upwards. Therefore shorts should be opened, understanding the market, having a plan of action if something did not go according to plan, for example the principles of risk management.

- Choose a pair for trading.

- The trading strategy is Long.

- Set a small leverage (5-10).

- Take profit and a step you choose depending on volatility of pair and your strategy and a situation in the market (usually these values from 0.5 to 1).

- The size of the first order, number of orders and martingale affect the trade amount. That is why we need to choose the optimal parameters accurately here, remembering that the grid width should also fit your strategy. The calculator section on the right will help us with this, showing several parameters. It is important for us that the amount of total margin (amount including leverage) is less than your deposit or allocated volume for this bot. Plus you should have at least 50% (preferably more) free funds in case the price goes against you, falls deeply, for example, when you are in a long position. Then you’ll have the funds to safely average out the trade and avoid liquidation.

The number of orders may be less if your pair has less volatility. Martingale increases the total margin of a trade, but is good for averaging. By reducing the martingale, you can increase the number of orders in the grid, for example. The choice of strategy is up to you.

If you run several bots, similarly check that the total margin of all transactions does not exceed your deposit. It is even better to have a reserve for averaging, as described above. Violating this MM rule, you risk losing your deposit.