The operating principle of the bot at Short (for the falling market)

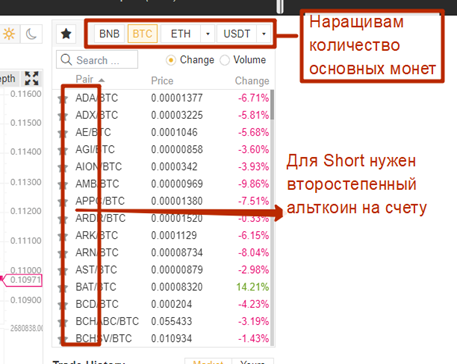

Cryptorg Bots in Short (for the market decline) allow you to increase the main crypto-currency pairs. For example, on Binance it is BNB, BTC, ETH, USDT having a secondary altcoin on the account. Please, do not confuse Short strategy on the conventional stock exchanges with margin trading on Bitmex, Bitfinex, etc. We don’t trade with leverage and don’t borrow money here.

For the correct operation you should have enough of one of the secondary coins on the exchange account. This coin must be free, not frozen in orders.

Consider the example of the BTC/XLM pair. In this pair we will increase the number of BTC having XLM on the account.

For example, we set up a bot with Take profit of 1 % and a Step of safety orders (SSO) of 1 %.

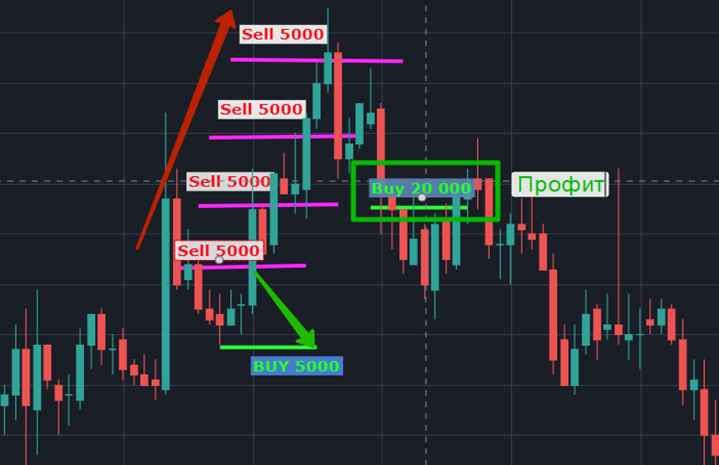

Bot sells 5000 coins, let us assume, 200 Satoshi (first order) and receives for this, for example, 0.2 BTC.

Bot immediately puts up for sale 3 SO (safety orders) at the price:

- 202 Satoshi – Sell 5000 XLM

- 204 Satoshi – Sell 5000 XLM

- 206 Satoshi – Sell 5000 XLM

At the same time bot puts up an order to buy the same 5000 coins (Take profit) at a price of 198 Satosh.

If the price falls to 198 Satosh the bot will buy back 5000 coins but spend 0.19 BTC at the same time.

0.2 BTC – 0.19 BTC = 0.01 BTC – this is our profit.

If the price rises the bot will close the deal with a profit at the price of 202 Satoshi and cancel the safety orders.

When prices increase, safety orders for the sale of 5000 XLM coins at the price of 202, 204, 206 Satoshi are triggered and the initial Take Profit moves slightly higher.

Thus, we averaged, thereby we increase Take profit when each SO (secure order) is triggered.

When 3 SO is triggered, we sell the amount of 20 000 coins (XLM) and when the price falls we need to close our deal with a substantial profit and buy back the same 20 000 coins.

In fact, our coins remain in the account but in the case of market disruption we earn BTC.

Bots in a short strategy can make a profit on the market growth too, if the price chart goes in waves allowing the bot to close by take profit.

The peculiarities of preferences

You can use the Short-strategy having on the balance of any altcoin, which is enough to set the desired amount of safety orders for the bot’s operation. Altcoin is configured for trading to 4 main coins on the exchange: BTC, ETH, USDT, BNB (KCS and NEO coins are also available for the Kucoin Exchange). A profit growth is in one of the 4 coins.

If you have one of the main coins of the DOM on the balance then you need to configure trading with such a coin not to altcoins, but only to the main ones.

Example:

If you have BTC on you balance:

You can trade only in pairs to the USDT for the work of Short-strategy (as well as other stablecoin)

If you have ETH balance:

You can trade in a pair to USDT and BTC for the work of Short-strategy.

If you have BNB balance:

You can trade in a pair to USDT, BTC and ETH for the work Short-strategy

You have on the balance sheet of USDT and other stablecoin:

In this case Short-strategy is impossible to use.

When setting up bots, it is important to take into account the rules of money management and the number of safety orders. The correct choice of signals to enter the transaction plays the important role. Read about it in the following FAQ articles.