Price restrictions

ATTENTION: Price restrictions and limitation of deals don’t work when selecting FOMO and Trading View technical signals

In trading is especially important to work with the price. The price chart can move for a long time in a certain range or break through different levels. All these moments affect the course of trading pairs.

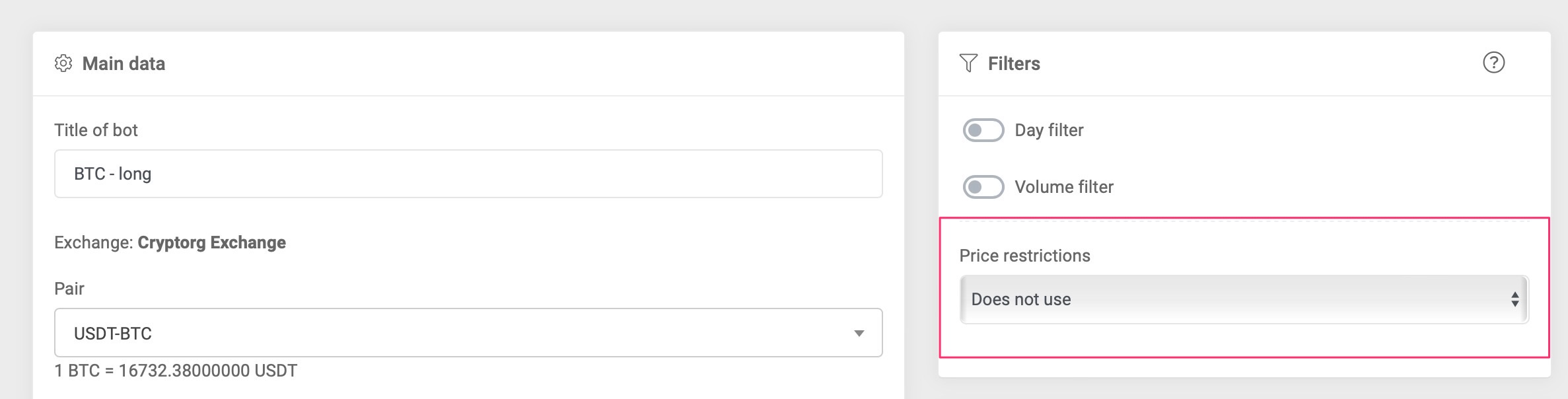

The form for setting price restrictions is located at the top right just below the filters when setting up bots.

The form opens when you select one of three conditions:

- Upper price limit

- The lower price limit of

- Upper and lower price limit

Let’s consider each constraint in order with examples.

Upper price limit

Immediately after selecting the upper price limit, the system will substitute the value above the current market price of 20%. On the left you can see the current price of the selected pair to quickly navigate the situation. You can change the price limit to any other value at your choice. The value can be set both above and below the current price.

Example with setting a limit above the current price:

For example, if you think that bitcoin is unlikely to rise above $17500 level and it will be actively sold off there, you can set this restriction in order not to buy above potentially dangerous level, from which it can roll back strongly. This can also be used as an escape from numerous altcoin pumps, when the bot can buy at the tops and then the price goes down strongly.

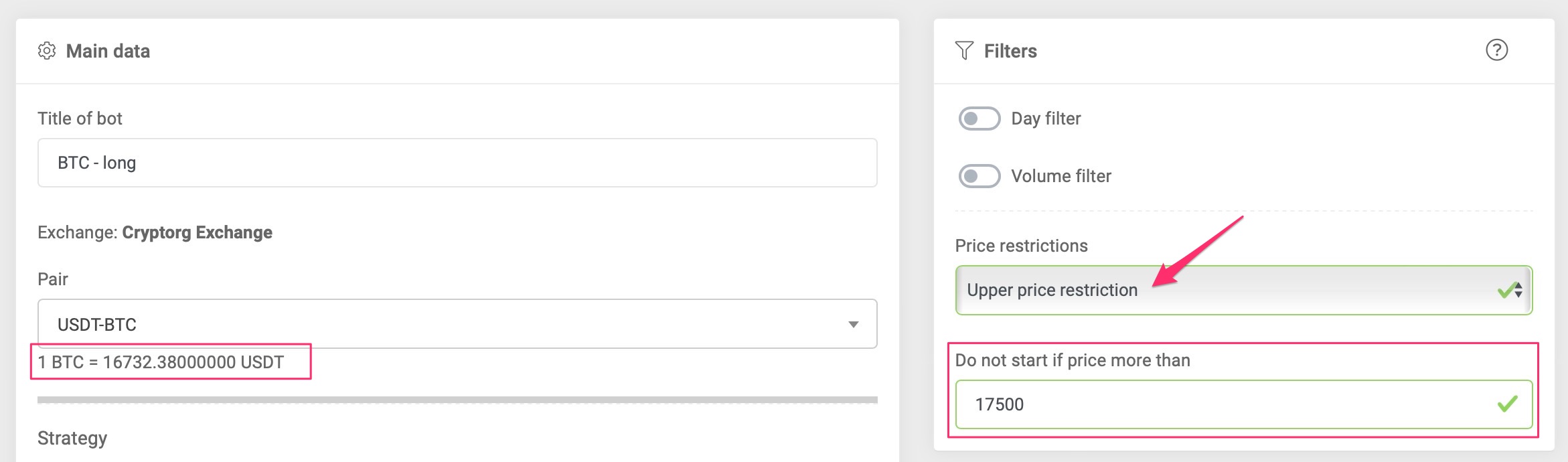

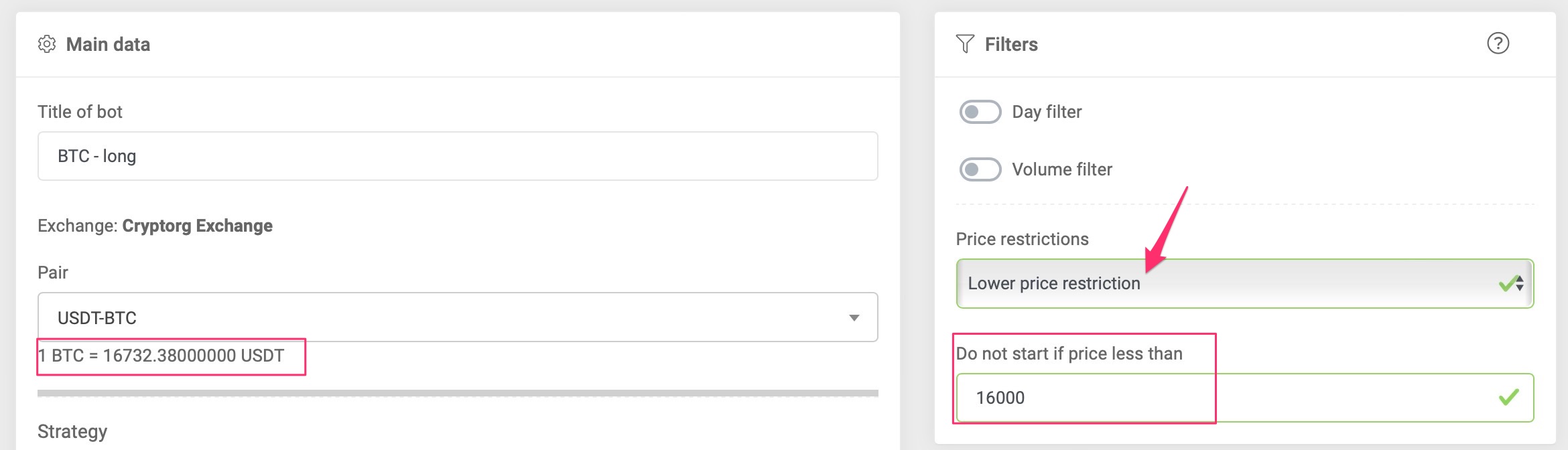

The lower price limit:

Immediately after selecting the lower price limit, the system will substitute the value below the current market price of 20%. On the left you can see the current price of the selected pair to navigate the situation more quickly. The price limit can be changed to any other value at your choice. The value can be set both above and below the current price.

Example with setting a limit above the current price:

At the current Bitcoin price of $16732, the trader assumes that the price will not go up. Until it breaks through the level of $16950. Having set a limit the trader works on a breakdown, the bot will open a long position immediately after the price overcomes the specified level.

Example of setting a limit below the current price:

At the current bitcoin price of $16732 the trader assumes that a breakout below $16000 will develop a downward trend. Setting a limit on the level of $16000 trader will limit the work of the bot in long below this level.

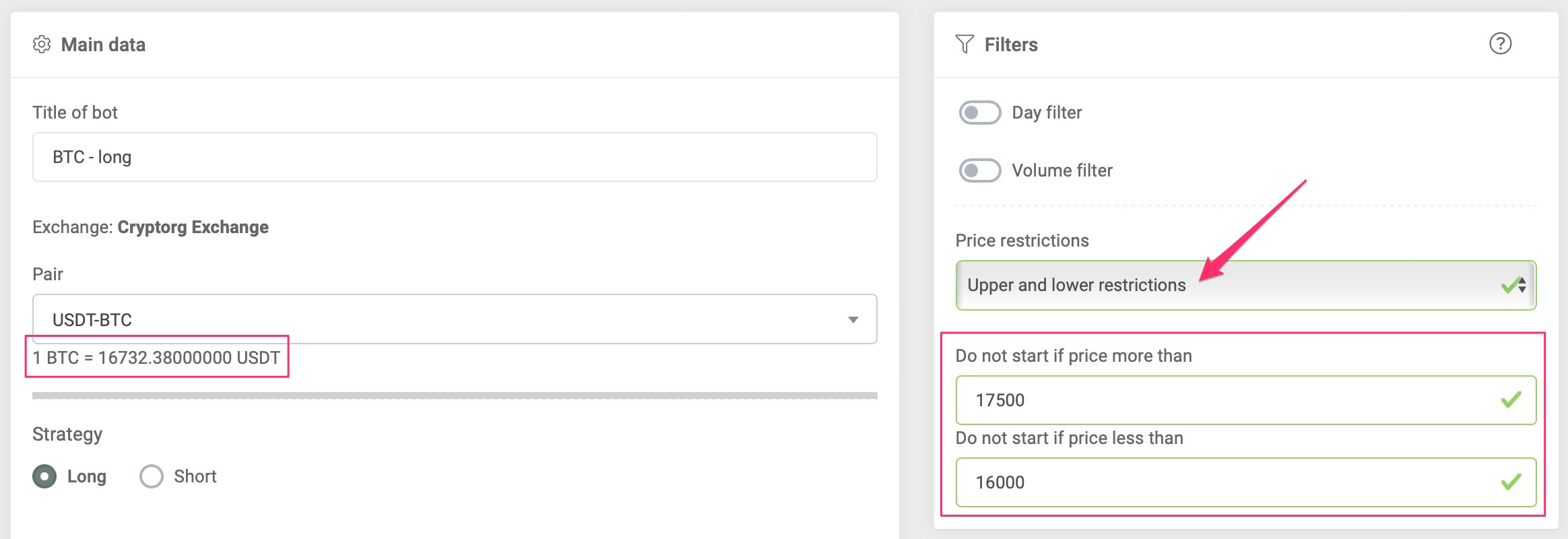

Working in the channel (simultaneous upper and lower price limit)

Immediately after selecting an operation in the channel, the system will substitute the value above and below the current market price of 20%. On the left you can see the current price of the selected pair to navigate the situation more quickly. You can change the price limits to any other value of your choice.

Example of working in a channel with a simultaneous upper and lower price value:

At the current bitcoin price of $16732 the trader assumes that the price will be in a flat between the $16000 and$17500 levels for a long time. By setting the upper value to $17500 and the lower value to $16000 the trader sets the channel for the bot operation. As soon as the price drops out of this channel, the bot will stop opening trades.

Pay attention to the following nuances in the work!

- In cases when the bot has an active outstanding transaction and the price falls out of the specified range, the bot finishes the transaction (continues averaging) and turns off when the take profit is triggered. When the TP is triggered, the bot analyzes the market situation. If it does not meet the price requirements, it ceases.

- The transaction entry can be configured both a limit order and the market. In the case of a limit order, the bot will set the order in the DOM and wait for its execution. At this time the situation is analyzedonce a minute and, if it’s necessary, the bot moves the order to a more favorable price, so that it is taken out of the DOM. Please note that the bot will place the initial order in the desired price range, but if it is not taken away for a long time, the initial entry can be made a little beyond the range.

- In the case of entering a market order bot takes someone else’s order from the DOM and enters the transaction when a favorable price situation immediately.

- Use price levels simultaneously with the option of Limit cycles. So you can control the bot operationaround or inside the price levels. For example, a trader believes that the flat will not last long and simultaneously with the setting of the price channel activates a limit of 5 trading cycles. After five take profits are triggered, the bot will deactivate itself, and the trader will assess the market situation and make a further decision.

- Price levels can be used for both Long and Short bots.

As mentioned before, price restrictions can be used in conjunction with the cycle Restriction. http://support.cryptorg.net/knowledge-base/cycles/

We specify the number of cycles and the channel in which the price will go. The channel can be set as support and resistance lines.