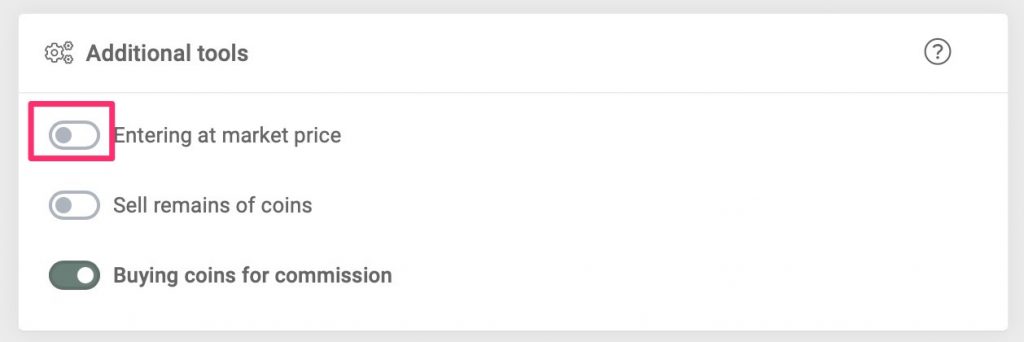

Trade entry, limit order and market access

When setting up bots the function of market transaction access is available.

By default, this feature is disabled and means that the bot enters the trade with a limit (pending) order. That means the bot puts a pending order (more profitable for us) and waits for its execution. Order execution may take several minutes. If the bot can not catch the price, it rearranges the order to buy higher.

If you do not want to wait for a limit order to be set and completed, you can enable access at the market price. Thus an instant buy order on DOM will trigger, and you buy someone’s sell orders (at different prices) until you collect the desired value.

In pairs with large trading volumes on the exchange you will not notice a significant difference when buying.

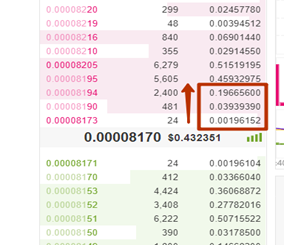

But if the pair is not liquid, then buying on the market may not be profitable for you, especially if the value of the first order is large. The price difference can be 1-3 %.

The market access solves several problems:

- The problem of partial execution of the initial order, when part of the value is executed the price rises up and the bot waits for a long time and can not do anything.

- When there is a rapid market, pump, impulse, and you want to enter the transaction as quickly as possible, for example, when using signals from third-party service or traders.